There was little surprise in the ‘throw in the kitchen sink’ too approach taken by the Morrison Government when it formally announced its 2020 Federal Budget this week. Much had been deliberately ‘leaked’ (as is common practice) before the official publication. The artillery barrage of more spending and tax cut measures was the showpiece that was expected, and it certainly was delivered to continue the fight against the adverse Covid-19 consequences that have hit the economy over the past six months, essentially because of the self-induced economic shutdowns.

The Budget was very specific and brief in its content really, as was its intention. It appears to have been well received by economists and by the market alike as a continued commitment of action shown by the Federal Government to get the Australian economy back on track, albeit it at a high cost as we know.

As usual, there are numerous economic releases the morning after a Budget night. I think the release below from Deloitte Access Economics provides a succinct description and interpretation (with the economist-style overlay!) of what this important Budget means.

Federal Budget: Jobs, jobs, jobs

On 6th October 2020, Treasurer Josh Frydenberg handed down a Federal Budget that reflects an extraordinary year in Australia’s history. The unprecedented spending program to support health and livelihoods in the face of the global pandemic, together with the associated economic fall-out, has resulted in an anticipated Budget deficit in 2020-21 of $214 billion with further deficits anticipated over the medium term.

This year’s theme is about jobs and investment, and the necessary steps Australia must take on the long road back to restore employment to pre-pandemic levels.

The key announcements were:

- Stage 2 personal income tax cuts to be brought forward from 1 July 2022 to 1 July 2020*.

(Note: These cuts are proposed and will still need to be passed and legislated in Federal Parliament but, once in place, these cuts will be backdated to 1 July 2020).

*Proposed Personal Income Tax Thresholds from 1st July 2020

(This table added here by FMA Wealth)

| FY 2020-21 marginal tax rate | FY 2020-21 tax bracket (current) | FY 2020-21 tax bracket (proposed) |

| Nil rate | Up to $18,200 | Up to $18,200 |

| 19% rate | $18,201 – $37,000 | $18,201 – $45,000 |

| 32.5% rate | $37,001 – $90,000 | $45,001 – $120,000 |

| 37.0% rate | $90,001 – $180,000 | $120,001 – $180,000 |

| 45% rate | $180,001 + | $180,001 + |

- Businesses with turnover of less than $5 billion can write off the full value of eligible assets used or installed by 30 June 2022.

- Companies with turnover of less than $5 billion can carry back losses incurred in the 2019-20 to 2021-22 years.

- New JobMaker Hiring Credit measure to encourage employers to hire young workers.

- Proposed Research & Development amendments refined and deferred to 1 July 2022.

- Government to invest additional $14 billion in new and accelerated infrastructure projects over the next four years.

- Record funding for hospitals, schools, childcare, aged care and disability services.

- 100,000 new apprenticeships and $1 billion in university research funding.

- Aged care funding up $2.2 billion, including $1.6 billion for 23,000 additional home care packages.

The 2020-21 budget is focused on driving unemployment down as fast as it can. That has seen a raft of decisions to tip new dollars into the economy, covering everything from the ‘bring forward’ of personal tax cuts, to subsidising the wages of the unemployed when they get a job back, through to allowing most businesses to immediately expense their capital spending.

The underlying cash deficit is forecast to be $214 billion in 2020-21, $29 billion worse than forecast in the July 2020 Economic and Fiscal Update, and a staggering $220 billion worse than the pre-COVID forecast released in late 2019 in the Mid-Year Economic and Fiscal Outlook (MYEFO).

The budget unveiled massive hits to the tax take, both in company tax (as profits dive) and personal tax (with jobs lost and wage growth virtually halting). 2020-21 revenues are forecast to be $55 billion lower than the (pre-COVID) projections in MYEFO.

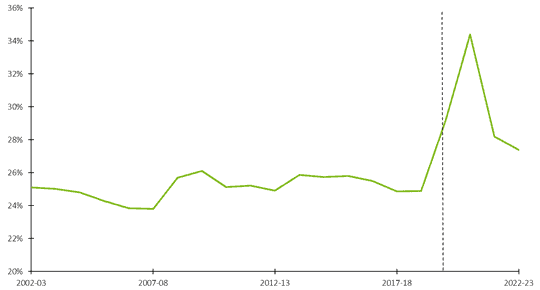

Yet the moves in spending dwarf those in taxes. The increase in spending is four times bigger relative to national income than in the global financial crisis (GFC).

In response to the GFC, spending rose by 2.4 percentage points of income in the two years to 2009-10. Now, spending is rising by 9.5 points of income in the two years to 2020-21.

Chart: Federal government spending as a share of the economy

Net debt is forecast at $900 billion in 2022-23, while in the MYEFO released pre-COVID, Treasury had projected net debt to be $361 billion in the same year.

Yet it’s what that debt costs that’s much more important. Treasury now forecasts $17.3 billion in interest payments in 2022-23. Strikingly, that’s less than the $19.0 billion we paid in 2018-19.

So, the defence of our lives and livelihoods is much cheaper than most realise.

Treasury has also pencilled in a rapid economic recovery, with a late 2021 vaccine allowing the economy to average growth of 3.5 per cent in the next three financial years. That rebound in growth is forecast to generate enough jobs to bring the unemployment rate down to 5.5 per cent as soon as mid-2024. And it is at this point that the government will start to worry about the deficit again.

Yet the economic costs will linger. With international borders set to be closed for some time yet, Treasury now projects Australia’s population in mid-2024 to be more one million people smaller than its pre-COVID expectations.

And, largely because of that, it now sees the economy in mid-2023 as around 5.0 per cent smaller than its pre-COVID expectations.

COVID has affected us all, and it has certainly come at a big cost to the economy.

IMPORTANT NOTICE

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms and their related entities. DTTL (also referred to as “Deloitte Global”) and each of its member firms and their affiliated entities are legally separate and independent entities. DTTL does not provide services to clients. Please see www.deloitte.com/about to learn more. Liability limited by a scheme approved under Professional Standards Legislation. Member of Deloitte Asia Pacific Limited and the Deloitte Network. © 202 Deloitte Touche Tohmatsu (ABN: 74 490 121 060).

If you would like more detail about the 2020 Federal Budget or, as always, should you have any queries or wish to talk about what is going on in these unusual and testing times, please do not hesitate to contact us at FMA Wealth.